Poignard

Well-Known Member

Ah but have you got a CQR? ?What kind of boat have you! I paid 765euros for that cover?..and thought I was doing well...and that was with new rigging and a survey from a year earlier...?

Ah but have you got a CQR? ?What kind of boat have you! I paid 765euros for that cover?..and thought I was doing well...and that was with new rigging and a survey from a year earlier...?

A meerkat on a boat advert should be fun! ?It's a shame that meerkat company don't offer a yachting insurance comparison.

I would be highly surprised if a meerkat could not swim.It's a shame that meerkat company don't offer a yachting insurance comparison.

I guess "recognised" is perhaps a better term - in other words someone who is acceptable to the insurers. In fact the rigger doing my mast has a BSc in Yacht Manufacturing and Surveying and has been in business as a rigger for over 10 years plus has professional liability insurance. I am sure there are many others with similar formal and experiential backgrounds. Equally there is nothing to stop anybody setting themselves up as a rigger, indeed there is no reason why you cannot do your own rigging. Whether this is acceptable to insurers is another matter.Not trying to be Rsey but genuinely interested if there is such as thing as a qualified rigger. When I skippered for a large charter Co. we did the pre-season rig inspections after a 10 minute chat with a Greek engineer. I'm not aware of any formal rigging qualifications. If they exist I'd be interested in obtaining them.

Yes....(in the garden)Ah but have you got a CQR? ?

I think marine insurance has been around for a long time....and I'd say the risk of loss is diminishing....so probably not a lack of box ticking.... More likely it's smal damage being repaired by yards at high costs....I would be highly surprised if a meerkat could not swim.

More likely that land based underwriters cannot fathom an unregistered moveable item that might sink, especially if only made in limited quantities with lots of owner maintenance and might also be decades old. That does not fit with computers and their neat little boxes.

Noble movedI have not had a survey since 2002 yet I have had fully comp insurance continuously since then.

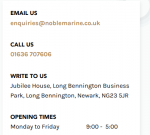

I am with Noble Marine Ltd (arranged through broker Richard Walton-Gould). They have accepted self-certification.

View attachment 126472

My boat is 54 years old and is insured for £15,000.

Thanks. I wasn't notified of that by the company.Noble moved

View attachment 126480

All about transferring risk. Somebody other than you has looked at/checked your rigging.I guess "recognised" is perhaps a better term - in other words someone who is acceptable to the insurers. In fact the rigger doing my mast has a BSc in Yacht Manufacturing and Surveying and has been in business as a rigger for over 10 years plus has professional liability insurance. I am sure there are many others with similar formal and experiential backgrounds. Equally there is nothing to stop anybody setting themselves up as a rigger, indeed there is no reason why you cannot do your own rigging. Whether this is acceptable to insurers is another matter.

Recently I talked to Navigators and General about raising the agreed value of Concerto due to the rise in secondhnd values, but they would only raise it by 10% without a survey or written valuation by a broker. So you may have to raise your agreed valuation over several years if you do not want to incur some fees.My boat is over 40 years old, and my insurers have never asked for a survey but I have been with them a long time and they are expensive (Pant's). This comment could well jinx me for next year.

On another tack. I have been generally easing down my agreed value over the years and recently saw a similar boat, arguably less well equipped, sell on an asking price 10 grand more. I am underinsured, against a total loss, on present day prices.

Agree totally. The agreement I have with the rigger is that he will go over it with me and advise what needs doing. i will strip off all the old wires, he will make replacements which I well fit next spring then he will check it all over, step the mast and set it up. Have followed this procedure on 3 previous rig replacements.All about transferring risk. Somebody other than you has looked at/checked your rigging.

I recently had my rigging replaced and just inspecting the mast with an experienced rigger and seeing what he was looking for and identifying stuff that had happened since the last replacement was an education.

On my old Eventide I insured continuously with Bishop Skinner since the 1990s based on a 1992 survey after a major refit with the same valuation. No claims in that period but in 2018 advised survey required before going afloat because new rules (for them) of 30 years and above. Sold the boat without a survey and new owner sailed it away. If I had kept the boat I would have stuck with third party because despite its condition and level of expenditure in the latest refit I sold it for £4k - a good price for such a boat, and to get a clean survey I would need to replace the 1992 rigging.My boat is over 40 years old, and my insurers have never asked for a survey but I have been with them a long time and they are expensive (Pant's). This comment could well jinx me for next year.

On another tack. I have been generally easing down my agreed value over the years and recently saw a similar boat, arguably less well equipped, sell on an asking price 10 grand more. I am underinsured, against a total loss, on present day prices.

.

My boat is over 40 years old, and my insurers have never asked for a survey but I have been with them a long time and they are expensive (Pant's). This comment could well jinx me for next year.

On another tack. I have been generally easing down my agreed value over the years and recently saw a similar boat, arguably less well equipped, sell on an asking price 10 grand more. I am underinsured, against a total loss, on present day prices.

.

I’m afraid you are possibly not just underinsured for a total loss, you risk being underinsured full stop.

Let’s say your boat is worth £10k and you insure it for £5k, they could potentially pay 50% of any (lower) claim.

I’m not an expert on policy wording but that’s definitely true with some insurance.

For goodness sake! Your boat is an appreciating asset, a classic desired by all with any aesthetic sensibilities and so good YM awarded it a higher score than some low price AWB. You should be increasing its value.On another tack. I have been generally easing down my agreed value over the years and recently saw a similar boat, arguably less well equipped, sell on an asking price 10 grand more. I am underinsured, against a total loss, on present day prices.

.

The "low priced" AWB has increased in value by about 20% in the last year and will sell for little less than it cost new 6 years ago having given an enormous amount of trouble free pleasure. Absolute bargain for both the current owner and the next one.For goodness sake! Your boat is an appreciating asset, a classic desired by all with any aesthetic sensibilities and so good YM awarded it a higher score than some low price AWB. You should be increasing its value.

You may be deemed to be self insuring for a portion of any claim. This could be expensive in the case of a 3rd party or pollution claim...(obviously this might not be straight forward if the brown stuff hit the fan) Much would depend on the phrasing of the policy document and any claim form that you might submit.Indeed but I don't think it will be a problem in practice, in this case.

It is the total loss that concerns me more. However the time beckons where I may consider going 3rd party esp if I am ever asked for an expensive survey.

You may be deemed to be self insuring for a portion of any claim. This could be expensive in the case of a 3rd party or pollution claim...(obviously this might not be straight forward if the brown stuff hit the fan) Much would depend on the phrasing of the policy document and any claim form that you might submit.