Keen4Moore

New member

So I have tried to look this up but can’t find find my scenario to see what would apply.

So firstly we have owned our powerboat for over a year and this is probably next summer we would look to ,move it anyway. Maybe later it all depends.

It was bought second hand from a broker and was originally bought in the UK all VAT paid etc. Value now circa £85k

The original plan was we went bigger to us it more in the UK Vs old boat we could trailer to France. But seeing as the British summer didn’t really turn up we ended up back down the South of France but boat less! At the mercy of hiring one locally which stung for just a few days.

So new plan, take the boat down the South of France (logistics TBC as that’s another conundrum) and then if we can find somewhere to keep it (yes I’m aware that’s hard work) leave it here and just get down here when we want to go boating.

Currently UK based but also looking at a move to France so would get citizenship etc at that point.

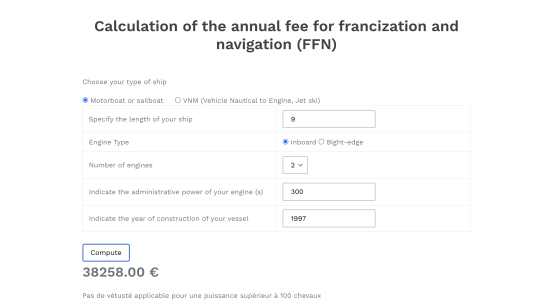

My query is around the French taxes. Does anyone know if anything would be liable? I see all the information about losing VAT paid if out of UK for 18 months, not too worried about that as I can’t see us bringing it back and sale wise… well that’s probably a long way off.

Everything I have seen is around people seeing things in the UK they want to buy and bring to France or vice versa. Not things they’ve already owned for some time and want to move and then leave there.

Hopefully someone has an idea on this

Thanks

So firstly we have owned our powerboat for over a year and this is probably next summer we would look to ,move it anyway. Maybe later it all depends.

It was bought second hand from a broker and was originally bought in the UK all VAT paid etc. Value now circa £85k

The original plan was we went bigger to us it more in the UK Vs old boat we could trailer to France. But seeing as the British summer didn’t really turn up we ended up back down the South of France but boat less! At the mercy of hiring one locally which stung for just a few days.

So new plan, take the boat down the South of France (logistics TBC as that’s another conundrum) and then if we can find somewhere to keep it (yes I’m aware that’s hard work) leave it here and just get down here when we want to go boating.

Currently UK based but also looking at a move to France so would get citizenship etc at that point.

My query is around the French taxes. Does anyone know if anything would be liable? I see all the information about losing VAT paid if out of UK for 18 months, not too worried about that as I can’t see us bringing it back and sale wise… well that’s probably a long way off.

Everything I have seen is around people seeing things in the UK they want to buy and bring to France or vice versa. Not things they’ve already owned for some time and want to move and then leave there.

Hopefully someone has an idea on this

Thanks