Kelpie

Well-Known Member

No tariffs, no quotas, that's the headline.

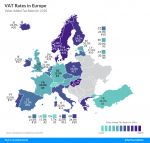

Does this mean I can carry on buying stuff from Germany via eBay, and not have to worry about paying VAT twice etc? I was going to buy a couple of solar panels but held off until we found out what was happening.

Does this mean I can carry on buying stuff from Germany via eBay, and not have to worry about paying VAT twice etc? I was going to buy a couple of solar panels but held off until we found out what was happening.